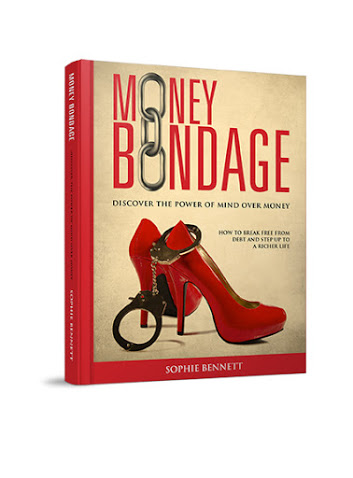

Sophie Bennett, personal finance and small business expert and author of new book Money Bondage knows about debt – she’s been there, and she’s been back. Here’s her essential advice about how to get richer

I was trapped by debts of more than £60,000. A few years later, I signed my first million pound deal. One day I just hit a brick wall, I knew there was nowhere left to go. Something had to change and I worked out that it had to be me.

Women today are under so much pressure. We all want to look good and yet we also have to be able to resist temptation. We need to present ourselves well and feel good about who we are, yet not overspend. We are supposed to eat healthy food, but great produce is expensive. We need our gadgets and smart phones, but all these things cost money. We live in a world where we have many difficult choices to make. Those contradictions are what got me into trouble. I was living the life that I wished I could live, not the one I could afford. It’s a trap many women fall into – and so much of it is caused by our natural need to either fit in – or stand out.

I had terrible money habits and I hadn’t understood that they way I thought about money had caused my debts. So how did I turn it around? I read everything about money I could and set to work. It took time to get the debts paid off and learned how to manage my income – and how to grow it year on year. My new book Money Bondage puts they most important things I learned about effective money thinking into one place.

I learned that managing money well is about managing your emotions first. It’s really easy to put a sticking plaster about how we feel inside by buying something nice or doing something that makes us feel better. The trouble with that is money worries almost always make us feel worse.

It’s tempting to escape our feelings by spending, but the cycle draws us deeper and deeper. It can be hard to stop. So much of being able to delay having what we want comes down to how confident we feel about ourselves. When we worry more about what other people think, we try and fix our appearance or the impression we make from the outside – not by fixing ourselves on the inside. When you are clear about who you really are and you want from life, it becomes easier to manage your money.

I have put together some tips to help Healthista women make more money in their own lives

1. Dream bigger than just paying your bills; dreams keep you going when times are tough

When you have a strong enough reason, you can do anything you set your mind to. Whether you want buy a house, or travel the world, dreams are a powerful force. Have something worth saving for; something that really excites you will help you to resist buying things you don’t really need. In the early days of working my way out of debt I used to keep a scrap book of all the places I would go and things I would do when I had my own money again. I imagined what it would be like to wake up in a beautiful place every day. Even though it felt a long way off, it really helped me develop the courage to make it happen.

2. Where focus goes, money flows. If you don’t want more problems then focus on making money, instead of losing it

It’s easy to get hung up about the bills and stressed out with financial worries. But all that stress affects your health, your sleep and your performance at work. By choosing where you focus your energy and attention you are taking back control of your life. You feel more motivated and alive. Choosing that mindset makes you more successful at work or in your business. You don’t need money to have a good attitude, you just need to choose your focus.

3. Spend less than you earn day by day; money quickly builds up when you apply small disciplines

This is a small idea that makes a massive difference over time. If you have debts at the moment, the first thing to do is to stop adding to them. That’s the first small discipline that really counts. Next you work on making a surplus each day or week. Living within your means quickly becomes a habit and saving a few pounds here and there quickly adds up. This little discipline becomes really powerful when you put the surplus into a separate pot; you get the satisfaction of paying off debt at first then watching the money build up! Daily or weekly savings may feel like a slow way to start, but it doesn’t take long for it to become a really powerful strategy – and a new habit for life.

4. Hard times teach you valuable lessons, so don’t waste the bad times, try and learn from them instead

Choosing how you respond to hard times one the key attributes of people who achieve massive success. It’s not about being cheerful all the time, it’s about being able to learn from your mistakes, close a door in your mind to past events and move on. All successful people learn from their failures by viewing them as feedback and then incorporating better strategies for next time.

5. Don’t wish you had more money, decide to have more

The language you use to yourself drives your unconscious behaviour. If you wish for things, your subconscious won’t really believe it’s possible to have them. Wishing, wanting and trying are all words that almost predict you aren’t going to succeed. If you really decide on something you open up different pathways in your brain. When yo`u start to pay attention to the words you use, you are on the pathway to success.

6. Set a clear target for how much exactly you want left over every month; you will be surprised how creative your subconscious gets

Study after study has shown that people with written goals achieve more than people without them. Setting a clear monthly money target will guide your subconscious to take the action needed to achieve your goal. Having something clear to aim for each month helps you to know if you are moving nearer or further away from the target. That helps you to change your approach if things aren’t working for you. Sometimes people worry that having a written goal will restrict them or add pressure, but in reality goals help you to stay flexible and adaptable. If that sounds odd, here’s why it works. Because the written goal only focuses on the outcome – not how you get there. The number leaves you totally in control of the approach. If you don’t hit it this time, you’ll learn something. If you do, you can celebrate.

7. Mix with new people to pick up tips and ideas. Meetup.com has thousands of local groups to join, many of them are free

New people stimulate new ideas and new connections can change your life when you least expect it. You might meet someone who could boost your career prospects or business. Recently I met best-selling author Shaa Wasman who told me that her big break came when she did a chance interview for her student magazine with the boxer, Chris Eubank. Chris offered her a job, and that meeting resulted in Shaa working personally with Richard Branson and James Dyson. Shaa has a stellar career and today is a best-selling author who runs several successful companies of her own and sits on the boards of other high profile businesses. It all started with a “chance” meeting.

8. If you haven’t got enough money, realise you just haven’t shared your talents widely enough yet. When you work out how to help more people, you will have more money

This is a core belief of almost everyone who makes it big financially. The more people you can reach, the more money you can make. If you can reach a big enough market, you can make a huge contribution to the world and solve all your financial worries as well. If you believe that, it’s possible for you to make it happen. If you don’t, it can’t happen.

9. Never let your dreams get swamped

Eleanor Roosevelt once said ‘A woman is like a tea bag, you never know how strong she is until she gets in hot water’.

Like this article? Sign up to our newsletter to get more articles like this delivered straight to your inbox.